Affiliate Disclaimer: Our product review team dedicates hours of research, fact-checking and testing to recommend the best solutions to business owners. We earn from qualifying purchases through our links, but this does not influence our evaluations. Why trust our reviews?

Written by Software Expert Hamza Shahid

A convenient, quick, and contactless checkout experience is what customers desire more than ever. Using mobile point of sale apps, you can take sales to your floor, at tableside, or off-site as needed, meeting those needs. Global Market Insights estimates that the global market for mobile point of sale (mPOS) terminals will reach $72 billion by 2027. In order to help you pick the best POS system for mobile business, we’ve outlined the 3 best mobile point of sale systems.

With the right mobile point-of-sale system, you can use it as a countertop system, a traveling POS system for events, and you can add mobile functionality to your brick-and-mortar restaurant or retail store. Besides line-busting and floor-selling, mobile point-of-sale systems can also be used for tableside payments.

| Our Experts’ Choice | Square Mobile Point of Sale System |

|

The best mobile point of sale system is Square. Square offers:

|

Don’t have time to read this whole review? Skip ahead to:

- Best POS System for Mobile Business – Overview

- What is Mobile Point of Sale?

- POS for Mobile Business: The Top 3 Vendors

- Square – Best for Any Business

- Lightspeed – Best for Advanced Retail Needs

- Clover – Best for Counter Service

- How Does a Mobile Point of Sale System Work? + The Benefits

- What Hardware Does a Mobile Point of Sale Need to Work?

- Types of Mobile Businesses That Need a Mobile Point of Sale Solution

- What Should You Look for When Comparing POS for Mobile Business + Why Should You Have One?

- FAQ

Best POS System for Mobile Business – Overview

Hundreds of retail and service-based business owners have long recognized the need for an advanced POS solution. It’s often something that proves to be vital for the growth and ease of management of their operation.

Today, mobile POS systems (known as mPOS) seem to be the star of the point-of-sale scene. A fully functional mPOS system comprises POS software installed on a mobile device, such as a smartphone or a tablet, with additional gadgets such as card readers or barcode scanners. The result is a portable, highly efficient checkout register that brings nothing but benefits for your business on the go.

The cost of a POS system varies, depending on the kind of hardware and software you opt for. If you’re starting a small business, you can opt for a simple card reader and free software, but for a growing company, a more sophisticated system will make more sense. You should also look for an easy-to-use interface. If the system is hard to use, it can slow down your daily operations and decrease your profit.

In addition to being able to keep track of your inventory, a POS system will help you automate back-office operations. Using this kind of software will save you time and money, as it will do much of the work for you. Additionally, it will prevent human errors, which is crucial for accurate financial counting. Furthermore, a POS system that is cloud-based will allow you to access the back office of the system from any location, giving you access to your business data at any time.

A retail POS system should offer real-time data and be customizable to the needs of the convenience store business. It should also have flexible fulfillment options, refunds and returns management, and advanced product search. A good retail POS system should also include a product-specific inventory management system.

Not all businesses would steer toward mobile POS systems, but it’s a perfect solution for many niches, some of which are becoming increasingly popular. Therefore, learning more about POS for mobile business is the logical step to take. It’s estimated that mobile businesses will continue to expand their presence in terms of market share, meaning that POS for mobile business will also become an important part of the POS industry.

All the above is the aftermath of the changing world we live in today. The recent pandemic and several other factors have transformed the way we do business and interact with various operations. The need for mobility has been recognized by business owners across the globe. All of them would surely be interested in learning more about POS for mobile business. If you are one of them, you should keep reading, as we are about to take a closer look at the trends and benefits related to this point-of-sale type.

What is Mobile Point of Sale?

According to recent trends, adoption of mobile point-of-sale systems is growing by 15.5% year-over-year. Retailers and restaurateurs find them increasingly attractive due to their portability and ease of use.

If you have ever shopped at a regular retailer or a street vendor at a town fair, you have probably made a purchase through a mobile point of sale system. Mobile Point of Sale systems function similarly to traditional cash registers, except they can be plugged into smartphones and touch-screen tablets.

Mobile point-of-sale systems run on smart or digital devices connected to the internet, bringing a world of opportunities to businesses, especially small ones, street vendors, and food trucks.

Instead of being tethered to one location like a traditional cash register, an mPOS terminal allows you to run your business anywhere in the world. It is important for businesses that do not typically operate from a brick-and-mortar store or businesses that do their most of their business on the road to take advantage of this. The majority of vendors who sell at street fairs, farmers markets, or conferences are traveling/off-site as they work. Their on-the-go business might not always be near their store to accept credit cards or debit cards, so mPOS systems make it possible for them to conduct transactions wherever they are.

It is essential to have an mPOS terminal if you want to compete in the modern business world as it allows any location to be a potential point of sale. Having access to a broader pool of potential customers gives your company access to geographical barriers that might limit your business. Additionally, you can access invaluable data via mPOS. This can be a game-changer for small businesses that do not typically have the resources to collect performance statistics.

You can analyze and act on valuable information about your business using the software an mPOS system runs on to improve the efficiency of your business operations. An mPOS terminal, for example, will collect information about your product inventory, such as which items sold the most or least and which locations resulted in the most sales. Business owners can easily analyze their sales performance with the help of this data in order to create targeted business strategies for the future.

POS for Mobile Business: The Top 3 Vendors

Our team of experts has scoured several mobile POS systems to find the three we believe deserve your attention. Finding the ultimate POS for mobile business requires a lot of comparing, but it starts with setting your priorities straight. You need to consider all the important aspects of your business before you invest in a POS system, but you also need to stick to your budget. The good news is that mPOS systems are affordable and most of them will allow you to use your existing hardware.

| System | Pricing | Top Features |

| Lightspeed | Payment processing starting at 2.6% + $0.10 per transaction, software costs starting at $69/month | Robust analytics and customer loyalty tools |

| Square | No monthly fees for basic software, 2.6% + $0.10 per transaction fee | Extremely accessible and easy to use |

| Clover | Free monthly plan for payment processing only, 2.6% + $0.10 transaction fee | Fully customizable with many integrations |

Square – Best for Any Business

In our list of top retailers, Square makes our list because of its suite of features that also work for quick-service restaurants and cafes. Quick-serve businesses and cafes use Square, while retailers and mobile service businesses use it as well, thanks to its versatility. A free online store and shopping cart integration allows you to sell online as well.

You only need a Square credit card reader and a phone (Android or iPhone) to start processing with Square. Although Square’s free magstripe card reader is an option, I recommend paying $49 for Square’s EMV/NFC reader, which accepts chip cards and contactless payments for a small price. You might consider Square’s proprietary hardware if you need something tougher than just the app and reader. It costs $299 and $799.

In contrast, Square Register has more features, including a customer-facing display, but it must be plugged in to work. Square Terminal is better if you need a mobile reader you can carry around.

Salient Features

Salient Features

Free Plan

In comparison to most POS apps, Square’s free POS can handle checkout, inventory, online sales, and more, unlike most POS apps that have limited features.

Usability

Customers and cashiers alike love Square, because it is so easy to use, with a simple design and durable hardware. Users rate it an average of 4.78 out of 5 stars.

Mobile

In the Apple App Store, Square POS ranks 35th for Business, with 4.8 out of 5. For Android, it has 4.4 stars, and over 138,000 reviews. It’s the most popular mobile POS application among users. In our list of the top free iPhone credit card readers and mobile payment processors, Square ranks first.

Scalability

It is perfect for those who are looking to run small, occasional businesses as well as large, busy businesses. Square offers reduced rates for high-volume sellers, however, while their flat payment processing rate is the highest on our list (except for Shopify).

Versatility

If you run a restaurant, Square POS has a special POS. Need something for your beauty salon? Try Square Appointments, which is also free. Square also offers an online store for free. As well as its POS, Square has branched out into banking with checking and savings accounts, loans, and more. These add-ons integrate natively into Square POS, including loyalty programs, employee scheduling, and payroll.

Pros

- Free mobile POS app for smartphones and tablets

- Simple, flat-rate processing

- Multiple mobile hardware options

- Robust feature set

Cons

- Not for high-risk businesses

- Expensive for high-volume businesses

Why Choose Square POS Application for Mobile Business?

Square is a popular name in the POS sector for all the right reasons. This point-of-sale vendor offers suitable solutions for retailers and restaurateurs, meaning that it also offers reliable POS for mobile business. The variety of features and the system’s versatility make Square a trusted partner. There are plenty of free integrations, too, which makes things even better.

The simple interface and seamless integration, alongside the flat-rate processing and the variety of additional hardware options, make Square a preferred POS partner. The above-mentioned toolset is one of the main reasons for Square’s POS for mobile business, of course. On the downside, this point-of-sale solution may be too costly if your sales volumes are relatively high.

Square POS Pricing

There is no monthly fee with Square and a flat-rate processing fee of 2.6% + $0.10 per transaction. If you’re a low-volume, low-risk merchant, then you’ll want to consider a different wireless POS system you can use with your own merchant account if you have a higher volume or higher risk business. If you make over $250K in revenue per year, Square may provide you with a processing discount.

Lightspeed POS – Best For Advanced Retail Needs

An iPad app from Lightspeed Retail offers an array of features. These include integrated ecommerce, advanced reporting, store credit, inventory management, the capability of buying items in bulk and reselling them individually, purchase orders, employee management, CRM, reporting, and multi store functionality (some of these features are paid add-ons).

You can take payments, display product images, and reduce waiting times by using an iPad with Lightspeed installed.

Lightspeed works great when installed on an iPad, which happens to be a popular device used by mobile businesses. Using this combination will let you accept payments anywhere and at any given moment. Since it’s quick and very easy to use, you will avoid long waiting lines and your clients will be happy to report the best customer experience.

Salient Features

Salient Features

Credit Card Processing

The LightSpeed processor eliminates the need to search for and apply for credit cards. Additionally, you’re not confined to LightSpeed’s processing and can use any merchant you choose. Additionally, LightSpeed guarantees the lowest processing rates available with custom quotes.

A Quick & Easy Checkout Process

In addition to pre-set item modifiers, custom layouts, color coding, and automatic discounts, LightSpeed includes features such as the cashier module that lets you tap a product picture or scan a barcode.

Inventory Management

In the retail environment, inventory management is a top issue. LightSpeed has a powerful, iPad-based inventory management tool with added features. You get a custom layout that’s intuitive so adding, editing, and removing inventory is simple.

Uploading and editing product information through spreadsheets eliminates manual updates and adjustments. Low inventory alerts let you know when product levels reach a certain level, and automatic reorders can be scheduled.

Customer Management

Automatic customer information data boosts sales and nurtures existing customer relationships. This feature captures information from every sale which is useful for mail campaigns. Customer loyalty reports include information about customer spending, purchasing trends, and top customers.

Evaluations of Employees’ Performance

Use the LightSpeed POS mobile app to measure employee productivity. The system includes a time clock that lets you track hours, allowing you to manage payroll.

Pros

- Extensive inventory processing functions

- 24/7 phone service and free onboarding

- Age verification

- Strong features for restaurants

Cons

- Hardware is custom quoted, more expensive

- Plans are expensive

- iOS only

Why Choose LightSpeed POS Application for Mobile Business?

Lightspeed is a popular POS solution that many restaurateurs and retailers have invested in. Still, it’s also a fitting POS for mobile business. The reason for that is simple: this point-of-sale solution has all the features you will ever need while on the go, including e-Commerce integration, reporting tools, inventory and order management, employee management, CRM, and Omnichannel support.

When you’re searching for the best POS for mobile business, you will probably bet on an advanced system with excellent reporting capabilities and an intuitive interface. Lightspeed is all of that, but it’s so versatile that it can also be used as a desktop checkout system.

LightSpeed POS Pricing

All in-person payments are processed by Lightspeed Payments, which charges 2.6% + $0.10, while card-not-present payments are processed by Lightspeed Payments. This is a similar rate as Square’s and does not make sense for retail stores with higher volume (although you might qualify for a better deal if you process more than $250K). If you use any processor other than Lightspeed Payments, you will be charged an extra $30 per month. Lightspeed Payments also integrates with multiple other payment processors, including WorldPay, Cayan, and others.

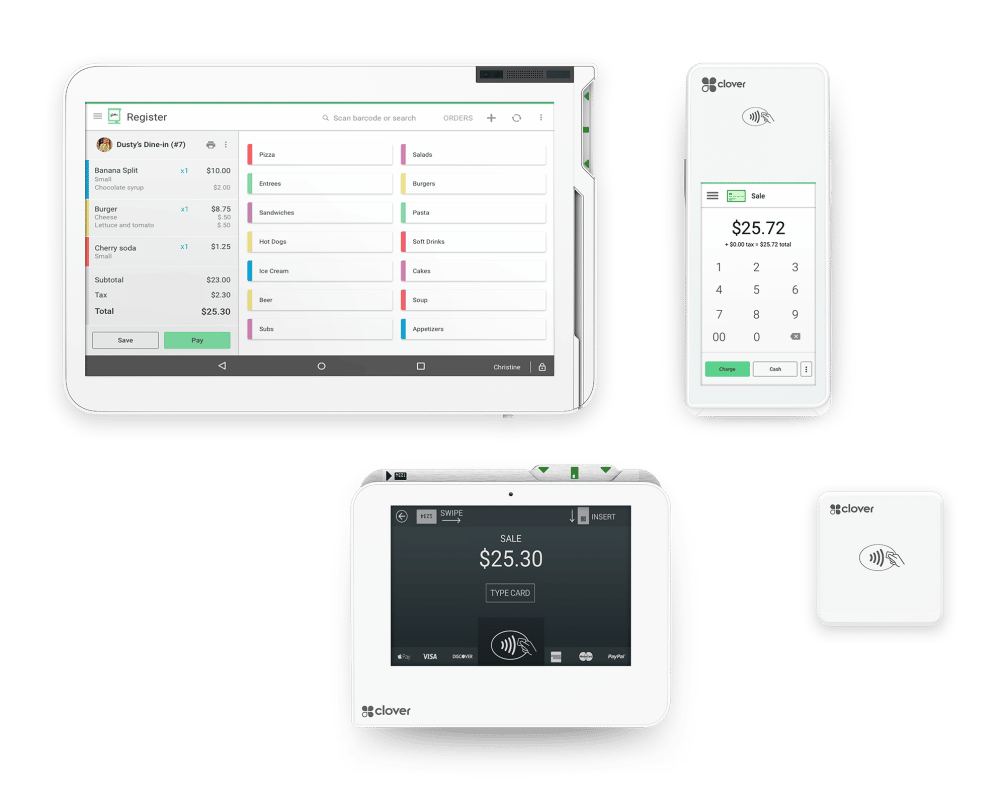

Clover POS – Best for Counter Service

With Clover’s POS app, hundreds of merchant accounts can use and sell it because it combines software and hardware. If you prefer to choose your own payment provider, this is a great advantage, but you can also get it from Fiserv with a flat transaction fee and plans. It is integrated with the hardware, but there are also Android and iOS versions available.

Although Clover offers several Android-based and purpose-built POS hardware solutions, the Clover Flex is the most mobile-friendly.

With a data plan, the $499 Clover Flex can serve as a line-buster, sell on the floor, or even outside your brick-and-mortar store. You’ll get a lot of power in the palm of your hand with the Clover Flex, which has a built-in swipe/chip/tap reader, receipt printer, and barcode scanner.

If you do not already use Clover Station or Clover Mini, neither of these mobile POS solutions is very suitable as a standalone mPOS. The Clover Mini can be connected to Wi-Fi, Ethernet, or LTE and has a built-in receipt printer, barcode scanner, swipe/EMV/NFC reader.

You cannot reprogram Clover plans to use a different payment processor since they are sold with a Fiserv merchant account. Choose one of these Clover resellers or buy directly from Clover to ensure the best Clover pricing and quality of merchant services.

Salient Features

Point of Sale

It features a robust POS system that accepts all forms of payments, allows you to set up discounts and refunds, allows you to set up virtual terminals for online ordering, and has an offline mode as well.

Customizable Receipts

Clover lets you create feedback coupons, as well as customizing receipts with general store information. Square can also customize receipts, but only if you also purchase Square Marketing.

Customer Engagement

There are various features in Clover, including loyalty programs, customer engagement, and rewards programs. You can also create profiles automatically updating credit card sales and contact information.

Clock In/Out

There is also a clock feature in Clover, Loyverse, Lightspeed, and Vend that allows employees to clock in and out of their shifts and track their tips. This is very helpful for establishing payrolls.

Mobile

In addition to POS, Clover has two other POS apps: Clover Go G1 and Clover Go G2. Clover Go G2 has 4.7 out of 5 ratings on Apple, while Clover Go G2 does better. Our list of best free iPhone credit card readers includes Clover Go G1, which has 4.2 out of 5 and over 2,000 reviews versus 3.3 and around 450 reviews for G2. If you have Android and just need the POS part of the software, we recommend Clover Go G1.

Pros

- Mix-and-match mobile hardware

- Add features using the Clover App Store

- Many Clover providers to choose from

Cons

- Many payment providers lock you into contracts, have hidden fees

- No low-inventory alerts

- No invoicing or vendor management

Why Choose Clover POS Application for Mobile Business?

Clover is another widely popular POS provider offering a variety of hardware options to choose from, including Clover Mini, an Android-based unit that has a complete set of features suitable for every mobile business. This POS solution is fully customizable and integrates effortlessly with several plug-ins and add-ons, creating the specific solution you’ve been looking for.

Plus, it’s roughly the size of an iPad, meaning that it would serve well as a POS for mobile business. It integrates well with e-Commerce platforms, too, meaning that you could combine your mobile operation with an online store, for example. The only negative aspect is the price. Clover Mini will set you back $749.

You can always opt for Clover Go instead. Choosing this POS for mobile business will allow you to take advantage of a mobile card reader that can easily sync with your existing hardware. Such a setup is more affordable and would probably suit your small or medium-sized business. Clover Go can accept payments through EMV and NFC technology, and it has a printer and a barcode scanner as well.

Clover POS Pricing

Clover offers a $0/month plan if you only want to use the device for payments (“Clover Payments” plan) at a 2.6% + $0.10 processing rate for card-present transactions, and 3.5% + $0.10 for card-not-present transactions.

Payments made without a card are known as card-not-present. To get better online payment processing rates, find a different merchant services provider or a different point-of-sale provider altogether if your business receives a substantial amount of online orders, delivery app orders, or phone orders.

You can upgrade to the $14.95/month Clover Essentials plan if you want basic inventory management features.

It features more advanced inventory management as well as a slightly lower payment processing fee (2.3% plus $0.10 for card-present transactions) and is priced between $44.95 and $54.90/month.

Also available are dedicated plans from $44.95/month to $94.85/month for full-service and counter-service restaurants. Depending on the software plan you choose and which Clover hardware you add to your Clover hardware setup, you could pay between $35/month and $290/month for your hardware and software.

Buyer’s Guide: How Does a Mobile Point of Sale System Work?

When it comes to POS for mobile business, there are plenty of similarities in the way these systems work when compared to traditional point-of-sale solutions. This is how mPOS systems work:

- Making a sale: Once the client chooses products or services, the person making the sale brings the mobile POS device they have at their disposal and initiates a transaction. This step may include scanning a barcode or a QR code.

- Price calculation: When you enter all the details related to the sale, the mPOS software will calculate the total amount the client must pay.

- Payment: The payment can be accepted in different ways, depending on the functionalities of the mPOS system and the preference of the customer. It may involve using a card reader.

- Transaction completion: Once the client pays using their credit card or digital wallet, for example, the mPOS system will process their payment. A receipt may be printed if needed. Once the transaction is complete, the system will update your inventory and engage other functionalities if present.

Benefits of Choosing a Fitting POS for Your Mobile Business

Benefits of Choosing a Fitting POS for Your Mobile Business

Mobile businesses need a suitable POS system if they want to provide their clients with the best customer experience and make sure not a single sale is missed due to an inability to take their money. When you count on attracting every single client and try to retain them and turn them into a regular one, then you need a fully functional mPOS system that supports smooth and quick transactions. Having such a point-of-sale solution will provide your business with:

Flexibility: Running a mobile business requires you to be as flexible as possible, meaning that you will need a POS system that combines all the functionalities you need with the easiest and fastest checkout process possible. The best mPOS system for you will allow you to reduce waiting time while giving you all the tools to manage your operation easier and faster. Being able to update your inventory and not keep a client waiting is one of the benefits of having a suitable POS for mobile business.

Mobility: This is the primary advantage of mPOS systems. Running a mobile business will require you to ditch the traditional checkout counter and replace it with a portable device capable of accepting and processing payments in seconds while giving you a complete toolset typical for any classic checkout.

Security: There’s no doubt in the fact that secure payments are just as important to customers as they are to business owners. This is why mPOS systems are a good investment: they offer data encryption and PCI compliance. Such features are enough to protect payment information from getting lost or stolen.

Ease of use: Your new POS for mobile business may be compatible with your existing hardware, meaning that it would be a breeze to use it. Even if you need to opt for the POS vendor’s branded hardware, it would still be easy for you and your clients to interact with the interface of popular operating systems such as Android and iOS.

Scalability: mPOS systems are highly scalable and allow you to add new checkouts easily and quickly. This is important for mobile businesses, as they could expand rapidly or increase the volume of their operation if it’s a seasonal gig, for example. This is why having a proper POS for mobile business is a must: it will reduce costs while giving you all the opportunities for growth you’d need.

Easily customizable: Having the means to customize your POS system is important, especially if you’re running a mobile business. Adding different features or plug-ins and having several settings allowing for a faster checkout process can be crucial for your business growth.

Reporting: Except for a smooth checkout process, your POS for mobile business will let you enjoy a variety of tools. You will benefit from automated processes such as reordering, inventory management and updates, client profiling, data collection aimed at creating successful loyalty programs, and more.

Better customer experience: All in all, a suitable POS for mobile business will help you deliver your services and sell your products in the best possible way. Your clients will not be interrupted or forced to wait. Instead, they will receive more attention from you and will be provided with a quick, seamless checkout process. This results in the ultimate customer experience that will make your clients come back.

Various payment options: This is an important aspect of mPOS systems, as it will allow you to be as competitive as possible. When it comes to payment methods, a modern POS for mobile business will guarantee you never miss a sale by being able to accept all popular types of payment. This includes credit and debit cards, gift cards, mobile wallets, and more. It all depends on the particular POS system you decided to go for, of course.

What Hardware Does a Mobile Point of Sale Need to Work?

The primary device you need to run your POS for mobile business is a portable gadget such as a smartphone or a tablet. Still, some point-of-sale vendors might require you to use their proprietary mobile device or a small terminal. However, there are cases when your operation might require additional hardware to function as it should. Let’s take a look at the additional devices you could use as part of your mPOS system.

- Card reader: Using a card reader is a must for most mobile businesses, as they need to be ready to accept card payments. Cards with magnetic strips are still widely popular, meaning that people use them often.

- Scanner: Barcode and QR scanners are among the possible devices mobile business owners might need, depending on the type of their operations. The barcode scanners you could opt for are all wireless, meaning that using them is convenient on the go. Of course, some POS solutions will allow you to use the primary device’s camera to scan barcodes and QR codes.

- Printer: Being able to print receipts is usually important for mobile businesses. If you need one, you will be glad to know that most mPOS systems are compatible with third-party printers.

- Cash register: Having a cash register is a must for some mobile business owners (food trucks, for example). Many clients still prefer to pay cash for the services or products they take advantage of, including when they are on the go.

Types of Mobile Businesses That Need a Mobile Point of Sale Solution

There are plenty of mobile businesses in need of a fully functional POS system that would give them the competitive advantage they need to thrive. There’s no wonder that POS vendors are considering the needs of mobile business owners more than ever. Movers, handymen, food trucks, landscaping engineers, mobile beauticians and massage therapists, plumbers, and dozens of other operations require a quick and reliable point-of-sale solution. This is where POS for mobile business comes in handy, literally speaking.

All of these businesses prefer mPOS systems for their speed, convenience, affordability, and flexibility. Here’s a brief outlook on the types of operations that need a suitable POS for mobile business:

1.Retail operations

2. Street food vendors

Every fast food kiosk or food truck needs to have a portable POS system for accepting payments fast and on the go. If you’re part of this industry, the right POS for mobile business will allow you to switch locations whenever you please.

3. Taxi drivers

Classic taxi companies and their modern competitors, such as Uber need POS terminals to be flexible enough to never lose a client. They often opt for POS for mobile business, as it is often a low-cost way to accept payments quickly.

4. Service providers

Specific services such as event photographers, plumbers, and handymen also need a portable POS solution. They can benefit from all kinds of add-ons and integrations, such as accounting software.

5. Fair and market attendees

Many brands decide to organize promotions and temporary shops on the street or in a shopping mall, for example. They also attend trade shows, markets, and fairs, hoping to make sales on the spot. This is why they would need an affordable, efficient, and easy-to-use point-of-sale system. Having a POS for mobile business would be the best option in this case.

What Should You Look for When Comparing POS for Mobile Business?

The right mPOS solution for your mobile business needs to cover the blend of requirements and preferences you have. This is why you need to opt for a feature-rich POS for mobile business that has every tool you’ll ever need. We’ll mention some of the features to look for when you are on the hunt for the ultimate point-of-sale system.

- Compatibility: Your new POS for mobile business should be compatible with various third-party software and hardware, as you might need to integrate it with something extra.

- Inventory management: To make the most of your POS system, you need to make sure it has all the features to track and update your inventory while you’re making sales on the go. This will help you manage your operation easier and quicker.

- Flexibility: You never know when you’ll need to add more checkouts to your operation, meaning that the POS for mobile business you invest in needs to be capable of supporting numerous terminals at one.

- Customizable interface: There are POS systems that allow you to create a custom checkout interface that completely suits your needs.

- Employee management: This is an important part of the tools your POS for mobile business must have. Being able to organize permissions, roles, and schedules while monitoring your employees is a must.

- Omnichannel support: Your mobile business obviously needs a specific POS system, but if you decide to extend it and add another location or an online store, for example, you would need a feature that combines the management and reporting tools for multiple checkouts.

Why Should You Have a Mobile Point of Sale System?

Businesses can now collect payments simply by owning a smart-device — mPOS terminals have revolutionized the way they do business. In addition to collecting payments at more locations, mobile point of sale systems automatically collect valuable sales data. It’s essential to keep up with consumer expectations in the data-driven world we live in by easily analyzing your business’s performance. It allows your business to operate more efficiently and grow faster with mPOS systems that collect and organize your sales transaction data.

Final Thoughts

The advantages of mPOS systems are too many to list, but even mentioning the most important ones is enough. Mobile point-of-sale solutions will help you set up a new location fast, meaning that your workflow will not be interrupted if you switch locations daily. Plus, it will also allow you to reduce queues, offer quick and easy payment to your clients, and achieve higher security levels.

The most appropriate POS for mobile business will also help you achieve greater efficiency and reduce costs at the same time. This is extremely important for all operations on the go, as keeping costs low is crucial for most of them.

Your mobile POS system will quickly prove to be more than just a system for accepting payments. It is one of the ways to earn a competitive advantage and create the means to manage your entire operation with a lot less effort.

Last, but not least: all the benefits of having a POS for mobile business are usually affordable. Most mobile businesses and startups prefer to have a low initial investment. This is another reason why you should think about selecting your specific POS for mobile business. Are you curious about the best mobile point of sale system? Just have a look at our best pick, Square POS.

FAQ

What devices can you use for running a mobile POS system?

You can either use your existing hardware or opt for the POS vendor’s proprietary devices, but it all depends on the point-of-sale system you choose.

How expensive is running a POS for mobile business?

The initial setup of most mPOS systems costs next to nothing, but the monthly fees and the payment processing fees depend on the functionalities you want to have.

Do you need additional devices to run a POS for mobile business?

Yes, most mobile businesses need additional devices to deliver their products or services the way they should. Additional peripherals include barcode scanners and printers.

How can you find a fitting POS system for your mobile business?

Before you compare the systems POS vendors have to offer, you need to prioritize the specific needs of your operation, compare them to the features of the POS systems you chose to learn more about, and consider your budget.

Salient Features

Salient Features Salient Features

Salient Features Benefits of Choosing a Fitting POS for Your Mobile Business

Benefits of Choosing a Fitting POS for Your Mobile Business