Affiliate Disclaimer: Our product review team dedicates hours of research, fact-checking and testing to recommend the best solutions to business owners. We earn from qualifying purchases through our links, but this does not influence our evaluations. Why trust our reviews?

Written by Software Expert Hamza Shahid

Food trucks, restaurants, and catering business owners may use this program to maximize and manage cash flow and track income and expenses.

QuickBooks will also help you collect vital information, report, and process sales tax more efficiently. The solution will also equip you with the data you need to manage costs and make intelligent business decisions.

| Our Experts’ Choice | Intuit QuickBooks |

|

QuickBooks is a feature-rich POS system made by Intuit. With its flagship titles, QuickBooks and TurboTax, the company has emerged as a leader in the accounting app market. It has:

|

Choosing QuickBooks POS System for Restaurant

Your restaurant accounting needs can be met by QuickBooks Online, a cloud-based accounting program. In addition to being suitable for various industries, it is also beneficial for people who work with bookkeepers or accountants regularly since you can share your files with them. Find out if QuickBooks Online is suitable for your needs and budget by reading our comprehensive QuickBooks Online review. After hours of in-depth research and evaluation, we can confidently recommend this brand to our readers.

What is QuickBooks Online for Restaurants?

Small and medium-sized businesses like restaurants and food hubs are the main focus of Intuit, and QuickBooks Point of Sale is no different.

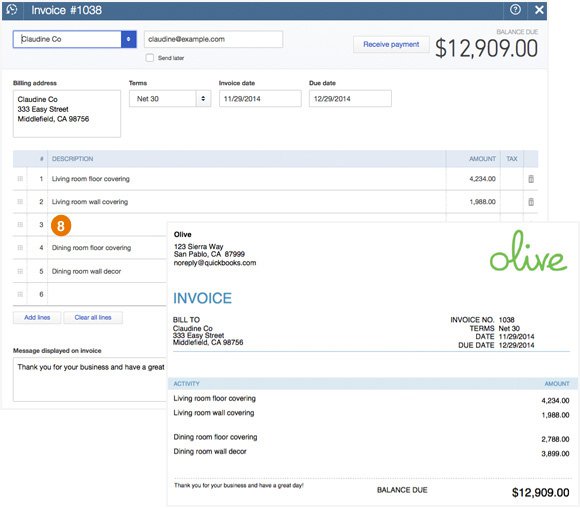

A cloud-based accounting program, QuickBooks Online boasts powerful reporting capabilities, customizable invoices, inventory management, multiple currencies, and over 650 integrations. You can also get features with QuickBooks Online that you won’t get with QuickBooks Desktop (automatic sales receipts, split transactions, scheduled invoices, and categories for locations and classes).

Small business owners love QuickBooks Live Bookkeeping, QuickBooks Capital lending, and the easy-to-use UI that makes this software a top choice.

You may experience occasional navigational difficulties, and the software has a semi-steep learning curve compared to its locally installed counterparts. You may find lengthy support waits frustrating if you need help. QuickBooks Online may be the ideal choice for businesses that want lots of features in easy-to-use, cloud-based software. Price increases throughout the years have made QuickBooks Online an expensive choice for some businesses.

Who is QuickBooks Best For? [How We Evaluated]

For small to midsized restaurant owners, QuickBooks Online is the ideal accounting software program. Our experts thoroughly evaluated QuickBooks Online through an internal case study to prove it deserves the top spot on our list of the best small business accounting software.

A total of 11 categories were examined, and QuickBooks Online exhibited excellence in restaurant banking, reporting, accounts payable, accounts receivable, inventory, and project accounting. Small businesses looking for an all-in-one software program to pay bills, invoice customers, generate reports, manage lists, and prepare taxes would benefit from QuickBooks Online.

To learn more about how QuickBooks can benefit restaurant owners, we had a discussion with Emily Morgan. Emily is a QuickBooks Online Advanced Certified ProAdvisor.

Emily stated, “Quickbooks Online is an affordable, user-friendly accounting software designed to help small business owners keep track of their cash flow, expenses, and income. For restaurant owners, QBO integrates well with apps like Stripe, Square, Bill.com, and PayPal. Every subscription level of QBO allows for users to upload their receipts from the phone QBO app and to track sales tax right there in Quickbooks Online. It even pulls the transactions in straight from the bank in a feature called the Bank Feed.

QBO has the added advantage of being accessible from any computer with an internet connection. The QBO Plus and Advanced subscription levels allow for restaurant owners to track income and expenses across different locations or classes and run customized reports for those locations and classes.

Business owners who use QBO can also add their bookkeeper or accountant on as a user.”

Why is QuickBooks Good for Restaurants?

Whether deployed on-premise or over the cloud, QuickBooks is ideal for restaurants of any type. However, its features and capabilities limit the usage of this solution in smaller businesses. The software comes in different versions to suit various applications.

For instance, it is currently being offered in QuickBooks Pro, QuickBooks Online, and QuickBooks Enterprise. Regardless of your preferred version, QuickBooks guarantees some of the industry’s best workflow automation and integration.

Discussed below are some of the capabilities that make QuickBooks stand out from other accounting programs:

Credit Payment Processing

This system supports all major credit cards, including Mastercard, Visa, Discover, and American Express. It integrates with the desktop system and facilitates the management of cash, credit, and debit cards.

QuickBooks POS claims to have the highest security protection against debit and credit card payments. With more than a million customers trusting the system, we can trust it. You do not have to pay per transaction for this credit payment processing software, which is excellent, especially for large companies. The pricing is fixed, so you will never be forced to pay more in the future.

Cash Flow Management

Managing cash flow in a restaurant has never been more effortless than it is with QuickBooks for Restaurant. This feature allows business owners to manage their finances and forecast cash flows. It will also equip you with valuable and actionable insights regarding your finances.

Stay prepared by forecasting money-in and money-out transactions. This software will accurately forecast such transactions for 30 to 90 days. Your data imports and syncs automatically for real-time cash flow analysis without needing multiple spreadsheets.

Desktop Integration

The card processing feature I particularly like is the seamless transfer of information from QuickBooks Desktop to the application. They work as one.

You will save time entering the sales information into the accounting software by integrating all transactions with the accounting program. You will also avoid errors that might otherwise occur when entering sales information manually into QuickBooks.

Sales Transaction Management

With this, you can add sales data in several ways. You can use a QuickBooks barcode scanner to add items. Additionally, you can manually add data using a Microsoft Surface Pro 4. Adding customer information and offering discounts can be done directly at thin e POS, saving you a great deal of time when it comes to accounting for discounts and other expenses.

Inventory Management

The system updates the inventory after each sale transaction with the advanced versions of QuickBooks POS, which are PRO and Multi-Store.

Consequently, you will know exactly how much stock you have at a given moment. With this critical information, you can adjust your product mix to serve your customers better and improve your profitability. By knowing what items are in high demand and which are not in tall order, you will be able to serve your customers better.

A convenient feature of the POS software is the ability to upload inventory items from spreadsheets.

Other QuickBooks Online Inventory Management capabilities include:

- Insights on Demand

Inventory reports are easily accessible, allowing you to instantly see your best sellers, total sales, and total taxes. The Inventory Summary report details precisely what products you have in stock. QuickBooks Online Plus and Advanced plans also come with various reports to make inventory tracking easier for restaurant owners.

- Instant Notifications

QuickBooks will help you stay ahead of backorders by sending you real-time notifications when it is time to order. While receiving the inventory, QuickBooks will convert that purchase order (PO) into a bill. This will ensure that you pay your vendor on schedule.

- Integration Support

QuickBooks supports integration with leading e-commerce platforms. This will ensure that you remain in sync with your online sales and inventory levels. In this regard, you can easily integrate with platforms like Amazon, Etsy, and Shopify.

With Amazon, the solution allows you to create a master inventory list and then sync all products across all your channels. As for Etsy, you can integrate sales data to your QuickBooks Self-Employed in order to get instant insights.

Integrating your QuickBooks to Shopify allows restaurant owners to automatically import their Shopify orders and refunds in a single click.

- Customers and Reward Programs Management

The system will enable you to manage credit customers and reward programs. You can get information about each credit customer, such as the due date, available credit limit, and other details.

With the POS system, you can also manage loyalty programs. Using the dashboard, you can track the promotions offered to customers and collect them all. You can print discount coupons and limited-time deals on receipts. It lets you create and manage loyalty programs to reward your best customers.

- Sales Tax Automation

QuickBooks makes the calculation of sales tax a lot easier. You only need to add sales tax to an invoice in QuickBooks, and the system will automatically carry out the relevant tax calculations. The solution calculates sales tax based on different attributes, including location, date, type of service or product, and customer.

Other sales tax calculation aspects you will come to like about QuickBooks include:

- Product Categorization

Sales tax calculation rules tend to vary from one state to another. Categorizing your products or services makes it easier for QuickBooks to apply the relevant tax rules. QuickBooks is designed to always use the correct tax rate in every transaction based on the product category and the sale location.

- Real-Time Figures

Get to know the amount you owe or are owed in real-time. The Sales Tax Liability Report allows you to view your sales tax information anytime. It will keep you updated on your taxable and nontaxable sales, with all figures broken down by tax agency.

- Bill Management

Organize and manage your bills online with confidence. With QuickBooks, you can accurately monitor and pay all your bills on time. The solution organises all your accounts in one place, ensuring you never miss a thing.

It will make it easy for you to track due dates and make payments directly in QuickBooks. You may also schedule them in advance for more accessible and faster expense management. QuickBooks offers flexible ways to settle up.

For instance, you can pay your bills online via bank transfer or debit card. You will be able to deliver multiple vendors at once, with the ability to choose how they receive their funds.

Other bill management tools offered by QuickBooks include:

Automatic Recording and Tracking

Any bills you settle by direct deposit or check will be automatically recorded and tracked by QuickBooks. As soon as you connect your business or bank account, QuickBooks will automatically import your transactions and match them to the respective vendor’s invoices.

Defer Bills

Control your cash flow by postponing the payment of bills. You can defer payments with a credit card and earn rewards. This way, you will be able to buy yourself a bit of time before your money becomes money. Transaction fees apply to this service.

Partial Bill Payment

QuickBooks makes it easy for you to make partial bill payments. You just need to enter the amount you would wish to pay. The system will automatically keep track of everything still owed on the bill. It will keep track of bill due dates, ensuring that they are paid in time.

Mileage Tracker

Did you know that mileage deductions can add up to a significant amount of your tax deductions? QuickBooks can help you drive up mileage deductions in your business. This feature will automatically monitor your phone’s GPS to know when you are driving.

You may also add each trip to QuickBooks manually. This feature is particularly beneficial for restaurants that offer delivery services. Easily categorise individual trips as business or personal for accurately tracking potential tax deductions.

The system displays a breakdown of miles and possible assumptions, making it easy for your drivers to share this information when needed. As you transition, you can automatically transfer your mileage from QuickBooks Self-Employed to QuickBooks Online.

Employee Time Tracking

Get the right set of employee time tracking tools to help accelerate payroll processing in your restaurant. The right time tracking application will ensure that you always have accurate timesheets and faster payroll.

Sync employee time to QuickBooks Online seamlessly and in real-time. Track time against specific jobs/customers, on any device, for timesheets that are accurate to the minute. With Tsheets by QuickBooks, your time data will automatically flow to QuickBooks.

Restaurant owners can save up to 5% on payroll costs and up to three hours on payroll runs by using this system. Restaurant owners can save up to 5% on payroll costs and up to three hours on payroll runs by using this system. Manage the restaurant and keep projects on track with accurate, detailed reports on employee hours.

Business Reporting

All QuickBooks versions feature built-in reports that keep you updated on how the company is caring and offer valuable insights. This solution’s various types of reports allow restaurant owners to track business performance and cash flow with straightforward reporting tools.

Get real-time small business insights with financial statements, such as income statements and balance sheets, on the QuickBooks dashboard. The cash flow statement allows you to track what is coming in and going out.

The solution will enable you to tailor your reports to your business needs. Create and share a professional summary of finances and business data with your business partners. Tailor your reports to the info that matters most, and keep your accountant in the loop with real-time email updates.

QuickBooks for Restaurants Pros and Cons

Pros

- Maintaining thorough records and compiling comprehensive reports.

- Third-party app integrations number in the hundreds.

- With QuickBooks Online Advanced plus, inventory management is included.

- If you need QuickBooks experts or online resources, you can easily find them.

- Reconciles banks efficiently

- inventory reports can be generated in a wide variety

- It has many bookkeeping features and is a capable mobile app

Cons

- Comparable products are a bit cheaper

- Inventory assemblies cannot be tracked like QuickBooks Desktop

- Time cannot be recorded on the mobile app

- Estimated costs cannot be compared to actual costs

How Much Does QuickBooks for Restaurants Cost?

Intuit QuickBooks accounting solution may be deployed over the cloud or on-premise. In either case, you will have several price plans to choose from for your needs. The QuickBooks option is suitable for small sole proprietors, partnerships, and restaurant corporations.

Regardless of your QuickBooks price plans, you will get free unlimited support. The provider offers a 30-day free trial and lets you cancel your subscription anytime, without any obligations.

These are some QuickBooks price plans for your business needs:

Simple Start ($12.00/Mo)

This plan will come in for any small restaurant, regardless of the type. It allows you to track income, expenses, sales, and taxes. With the QuickBooks EasyStart plan, you can capture and organize receipts, automatically track mileage, and run all the relevant reports.

You will also be able to invoice and accept payments, maximize tax deductions, and even send estimates. The plan also supports progress invoicing.

Essential ($25/Mo)

This plan offers such capabilities as tracking sales, sales tax, income, and expenses. It will also allow capturing and organizing receipts and automatic mileage tracking. This QuickBooks plan enables restaurant owners to maximize their tax deductions, send estimates, and run reports.

In addition to multiple user support, this plan allows users to manage bills and payments and process numerous currencies.

Plus ($40.00/Mo)

This plan best suits medium-sized restaurant businesses. In addition to the features and capabilities of the Essential and Easy Start plans described above, the Plus plan offers a few more features.

It supports multiple currencies and provides time and inventory tracking capabilities. It is also packed with the tools you need to gauge and keep track of the project’s profitability.

Self-Employed ($7.50/Mo)

This is an Intuit QuickBooks subscription plan specifically designed for freelancers. It is best suited for sole proprietors who need to file a T1. Even so, it will also help you keep an accurate track of income and expenses and monitor sales and related tax.

It can also capture and organize receipts, run reports, and track mileage. This plan allows you to invoice and accept payments and sort business and personal transactions accordingly.

QuickBooks Online for Restaurants: Past vs. Current Edition

It’s essential to mention that the most recent QuickBooks Desktop (QBDT) version you can download or activate from the official website is 2010 from the list below. Unfortunately, QuickBooks 2008 and 2006 no longer support the applications, and we cannot start them as new versions. You can use the following versions of each product:

- QuickBooks Desktop Pro – from 2010 to 2024 or Pro Plus version.

- QuickBooks Desktop Premier – from 2011 to 2024 or Premier Plus version.

- QuickBooks Desktop Desktop Enterprise – from 2010 to 2024 version.

Customer Reviews of QuickBooks Online for Restaurants

We have collected some of the individual reviews and an overall assessment from trusted sites such as Capterra and Trustradius.

The Bottom Line on QuickBooks for Restaurants

Intuit QuickBooks is an affordable, feature-packed accounting solution that will come in handy in a small restaurant business. The provider offers multiple software versions to meet diverse business needs and budgets.

Your choice of the correct QuickBooks version should be influenced by your business accounting needs and the number of employees. QuickBooks allows for integration with several applications and e-commerce platforms for enhanced versatility.

Once integrated, it will sync data in real time for accurate accounting and reporting. You will get a 30-day free trial to gauge QuickBooks features first-hand before subscribing to any of their plans. All in all, QuickBooks offers better value for money than some leading accounting programs.

Frequently Asked Questions

What is QuickBooks POS Best suited for?

The QuickBooks POS software is best for restaurants, bars, shops, and other retail service businesses. Large businesses with millions of monthly transactions may find it too limited for their needs.

What are the requirements for QuickBooks?

The POS software runs only on Windows systems. The system is also compatible with the MS Surface Pro 4 tablet. The hardware requirements are as follows.

- Processor: 2.8 GHz processor recommended for single users; 3.5 GHz for multiple users.

- Disk Space: 1 GB disk space minimum

- Memory: 6-8 GB Ram recommended for a single workstation.

- Screen Resolution: 1280*768 or higher

QuickBooks POS hardware is the only one that will work with it. Hardware purchased from other sources may not work either, and Intuit’s API isn’t accessible to other products, so there is no guarantee that it will work with Intuit’s POS. The 16.0, 17.0, and 18.0 versions of QuickBooks Enterprise Solutions can be integrated with this Point of Sale software.

How do I get QuickBooks Online for free?

If you’re a business owner that is also an educator or a student, you can get the program free after a validation process.

What is the difference between QuickBooks and QuickBooks Online?

Compared to QuickBooks, QuickBooks Online has a more robust set of inventory management features that could be helpful to many small business owners.

What do accountants think of QuickBooks Online?

Intuit reports that 94% of accounting professionals feel QuickBooks Online saves them time and thus keeps their clients’ money.

How many different versions of QuickBooks are there?

Currently, there are six different versions of Intuit’s QuickBooks:

- QuickBooks Online: Best for small to medium-sized businesses (SMBs) with up to 25 users; a cloud-based version of QuickBooks; provides more than 650 integrations with other software

- QuickBooks Self-Employed: Best for freelancers and solopreneurs

- QuickBooks Pro: Good for SMBs; ideal for up to three users; offers more advanced features than QuickBooks Online as well as additional software integrations

- QuickBooks Premier: Ideal for medium-sized businesses with up to five users; best for industry-specific companies; also offers advanced features

- QuickBooks Enterprise: Best for large companies with up to 40 users; even more advanced features than QuickBooks Online, QuickBooks Pro and QuickBooks Enterprise

- QuickBooks for Mac Plus: Best for SMBs for up to three users; similar to QuickBooks Pro